flow through entity taxation

Structuring the Flow-Through Entity. Notice IIT Return Treatment of Unemployment Compensation.

Pass Through Business Definition Taxedu Tax Foundation

Flow-Through Entity FTE Tax Credit.

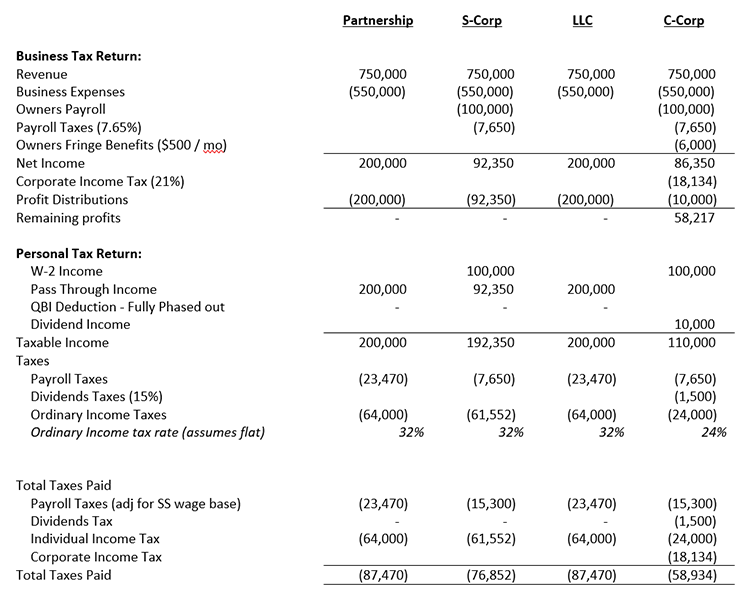

. Likewise you will also need to pay state and local taxes as applicable. Eliminating C and S corporation penalty taxes by utilizing partnerships and other mechanisms. Instead their owners include their allocated shares of profits in taxable income under the individual income tax which is taxed as ordinary income up to the maximum 396 percent rate.

FTE Tax Credit and Michigan IIT Return Form MI-1040 FTE Tax Credit and Michigan Composite IIT. Flow-through entities are used for several reasons including tax advantages. Rather than paying a separate tax on the business investors pay tax on their income and this covers the business entity.

In the end the purpose of flow-through entities is the. Flow-Through Entity Tax Payments Due by March 15 2022 To Create a Member Income Tax Credit for Tax Year 2021. Flow-through entities are considered to be pass-through entities.

CO aims to bring you inspiration from leading respected experts. Flow-through Entity Tax Quarterly Estimated Tax Payments for Tax Years Beginning in 2021 Not Subject to Penalty or Interest. There is no double taxation in a flow-through entity no separate tax is levied on the income of the entity and the income of the owners.

That is the income of the entity is treated as the income of the investors or owners. Flow-through entities are also known as pass-through entities or fiscally-transparent entities. 2018 5 2019-2025 10 2026 beyond 125 usually the 10 will begin to apply when payments to foreign affiliates exceed taxable income by more than 10 - BEAT does not apply to individuals S Corps RICs or REITs.

How Pass-Through Entities Pay Taxes A flow-through entity does not pay federal corporate tax. ADVANTAGES OF FLOW-THROUGH ENTITIES Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. The flow-through entity tax is retroactive to tax years beginning on and after January 1 2021.

Utilizing partnerships and LLCs to solve S corporation structuring limitations. Instead the business income passes through the business to their owners and the owners pay tax for the first time on their personal tax returns. Estates and Trust Income Tax.

View FTE Business Tax FAQ. FTE Tax Credit FAQs. BEAT - Additional Rules.

Also losses accrued by the entity can be used against the personal income of its owners. My recent article critically analysed the range of reasons that have historically been used to justify applying entity taxation to corporations. That article argued that those reasons do.

The range of features that comprise each method of taxation entity taxation and flow-through taxation are set out in previous work see here and here. This means that the flow-through entity is responsible for the taxes and does not itself pay them. Structuring the admission of the service provider.

Instructions for Electing Into and Paying the Flow-Through Entity Tax. General FTE Tax Credit. City Individual Income Tax.

City Individual Income Tax. A flow-through entity FTE is a legal entity where income flows through to investors or owners. Understanding What a Flow-Through Entity Is.

Virtually all states recognize traditional general partnerships and limited partnerships as flow through entities for taxation purposes. Study with Quizlet and memorize flashcards containing terms like T or F. Any flow-through entity making a 2021 election after the due date of the flow-through entity tax annual return March 31 2022.

The main issues here are not so much status issues but the applications of taxation to the model of a flow through entity. Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated payments due for tax year 2021. City Business and Fiduciary Taxes.

FTE Tax Credit FAQ. Small and closely held corps may elect to be taxed as an S-Corp All the income gains losses and deductions of an S-corp are flowed through through where What form is. Most flow-through entities including most LLCs are subject to IRS self-employment tax 153 of your earnings according to the Motley Fool.

City Business and Fiduciary Taxes. If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity the elected capital gain you reported created an exempt capital gains balance ECGB for that entity. The continued levy of the tax is contingent upon the existence of the federal state and local tax SALT deduction limitation codified within IRC 164b6B.

Using qualified S corporation subsidiaries and single-member LLCs.

Pass Through Taxation What Small Business Owners Need To Know

California Enacts Changes To Elective Pass Through Entity Tax Hcvt State Local Tax Holthouse Carlin Van Trigt Llp

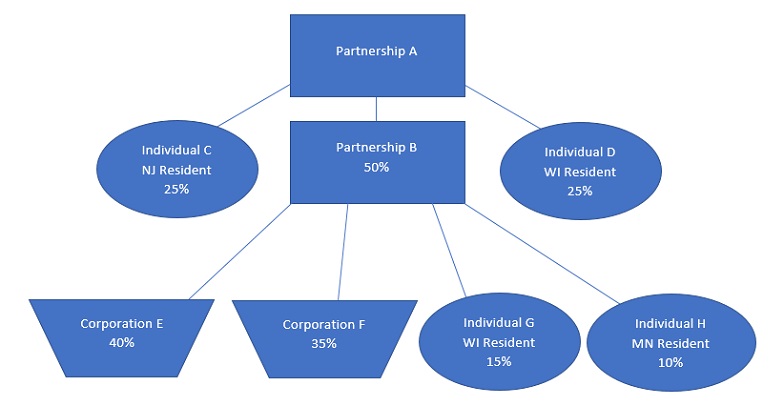

Dor Pass Through Entity Level Tax Partnership Determining Income And Computing Tax

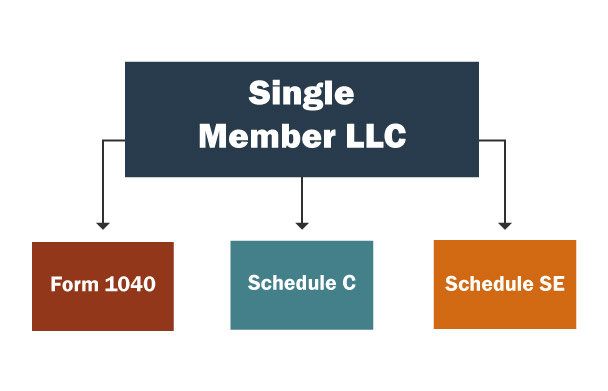

Llc Taxes Single Member Llc Taxes Truic

How To Choose Your Llc Tax Status Truic

What Is A Pass Through Entity Definition Meaning Example

Flow Through Entity Overview Types Advantages

Pass Through Entity Definition Examples Advantages Disadvantages

Jp Magson Private Client Wealth Management

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

Pass Through Entity Definition Examples Advantages Disadvantages

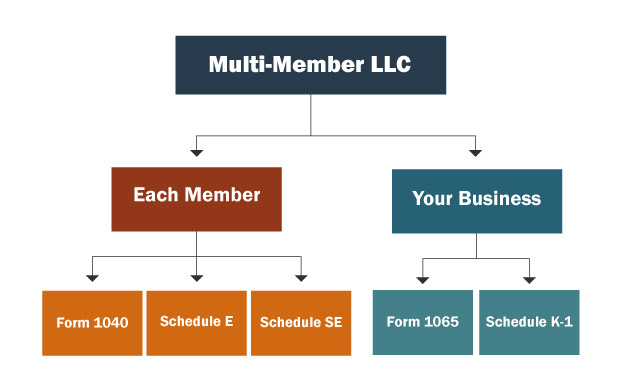

Multi Member Llc Taxes Llc Partnership Taxes

How To File The Inventory Tax Credit Department Of Revenue

What Are The Tax Implications For An Llc Effects Of Operating As An Llc

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant

Business Entity Comparison Harbor Compliance

Pass Through Entity Tax 101 Baker Tilly